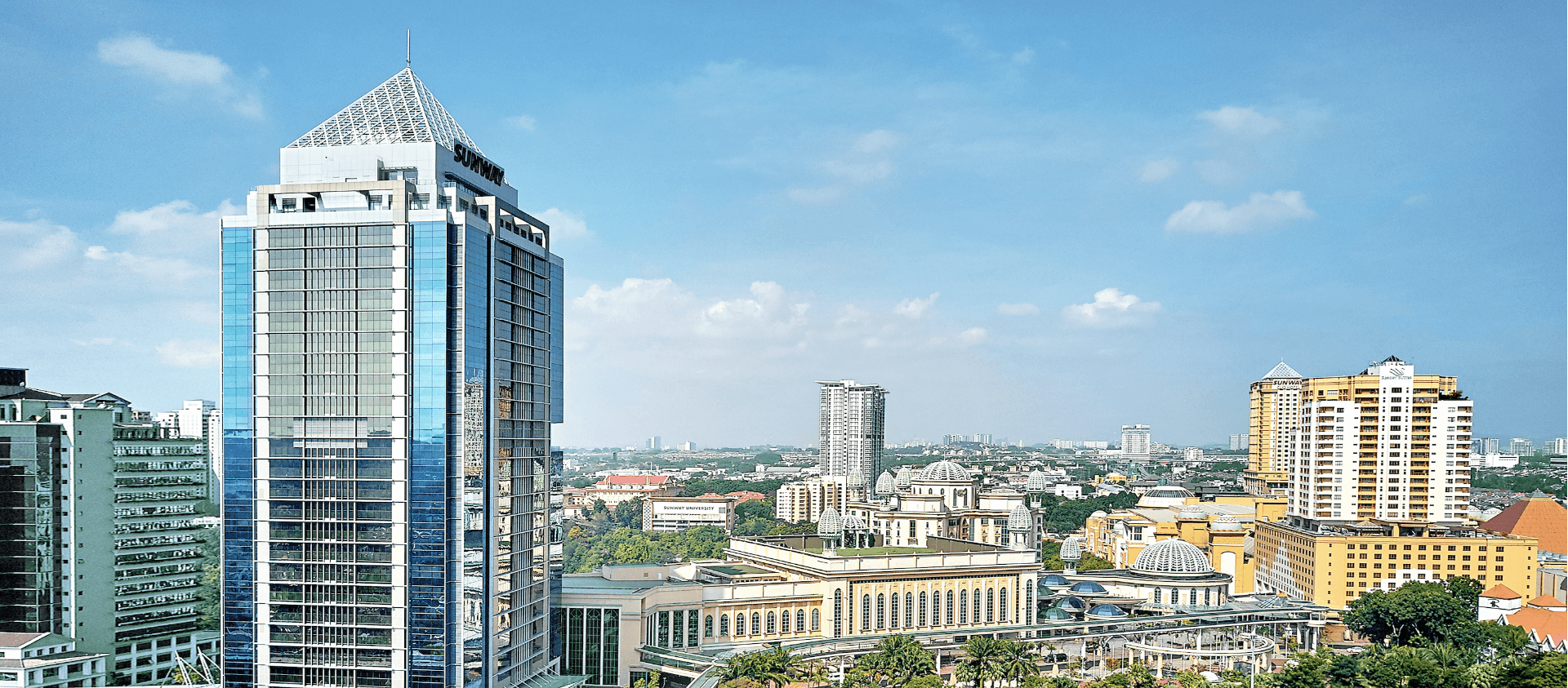

Sunway City Kuala Lumpur,08 February 2021

Sunway REIT Management Sdn. Bhd., the Manager of Sunway Real Estate Investment Trust (Sunway REIT), is pleased to announce its financial results for the second quarter ended 31 December 2020.

Second quarter unaudited financial results for the period from 1 October 2020 to 31 December 2020

Sunway REIT announced a gross revenue of RM95.8 million and net property income (NPI) of RM66.0 million for the second quarter ended 31 December 2020 (2Q FP2021) as compared to RM155.8 million and RM116.6 million respectively for the corresponding quarter in the preceding year (2Q FY2020) as a result of the uncertainty and challenges brought about by the COVID-19 pandemic. During the quarter under review, the recovery of the Retail and Hotel segments were impacted following the reinstatement of conditional movement control order (CMCO) in various states in the country amidst the resurgence of COVID-19 cases.

Gross revenue for the Retail segment for the quarter under review stood at RM56.8 million, from RM106.7 million in 2Q FY2020, attributable to the implementation of CMCO in October which has stalled the footfall and sales recovery in 2Q FP2021. In tandem with that, the Retail segment recorded a NPI of RM33.9 million, from RM74.0 million in 2Q FY2020.

The hotel industry continued to be adversely affected by the challenging market conditions, of which hotels under Sunway REIT’s asset portfolio collectively posted a gross revenue of RM7.9 million in 2Q FP2021 compared to RM22.6 million in 2Q CY2020 owing to ongoing international travel restrictions, limited domestic travel activities and cautious sentiment as a result of the increasing COVID-19 daily cases. The further restrictions on interstate, district and inbound travel, on top of strict standard operation procedures (SOP) imposed on group and corporate events have constricted the overall hotel industry’s businesses.

That being said, Sunway Resort Hotel took the opportunity during this lull period to refurbish and upgrade in phases to position the hotel for the upswing in demand upon the recovery of the COVID-19 pandemic. This transformational refurbishment which is slated to be completed by 2021 will bring a whole new experiential experience for both business and leisure travellers, setting the benchmark for Sunway City Kuala Lumpur as Asia’s leading integrated resort and a regional tourism hub.

On the other hand, the Office segment posted a 40.0% year-on-year (y-o-y) jump in gross revenue to RM14.5 million in 2Q FP2021, from RM10.4 million in the same quarter last year. The rise in the gross revenue is attributable to the recently completed acquisition of Sunway Pinnacle in November 2020 which contributed an additional income of RM4.1 million to the Office segment. The other office properties under management grew 0.6% on average on the back of stable occupancy rate. NPI surged 64.5% y-o-y to RM9.0 million in the period under review compared to RM5.5 million in 2Q FY2020, on higher gross revenue and effective cost containment measures.

For the Services segment, gross revenue and NPI recorded a 2.8% y-o-y growth to RM15.0 million, boosted by the annual rental reversion of Sunway Medical Centre and Sunway university & college campus. The Industrial & Others segment’s gross revenue and NPI remained stable at RM1.5 million.

Despite the challenging operating environment, Sunway REIT continues to maintain an income distribution payout ratio of at least 90% of distributable income, which amounts to RM26.4 million or a distribution per unit (DPU) of 0.77 sen in 2Q FP2021.

Cumulative six months unaudited financial results for the period from 1 July 2020 to 31 December 2020 (6M FP2021)

For the 6M FP2021, Sunway REIT registered gross revenue and NPI of RM203.2 million and RM134.1 million respectively. This is compared to a gross revenue of RM311.2 million and RM235.7 million respectively during the same period in the preceding year (6M FY2020).

An encouraging recovery in the Retail segment was witnessed in 1Q FP2021 following the easing of movement restrictions coupled with festive celebration that have attracted encouraging footfall tractions and retail sales. However, this was offset by softer footfall in 2Q FP2021 with the re-introduction of CMCO on 14 October 2020 in various states in the country which impacted the overall Retail segment’s performance. The Retail segment recorded gross revenue of RM134.5 million for 6M FP2021, compared to RM212.3 million in the same period last year.

NPI from the Retail segment for 6M FP2021 stood at RM78.1 million, from RM149.3 million in the same period last year on the back of the ongoing rental support programme provided on a case-to-case basis to assist affected tenants, lower turnover rent and car park income.

The Hotel segment recorded gross revenue of RM10.7 million for the 6M FP2021, from RM46.2 million in the corresponding period in the preceding year. In the period under review, the Hotel segment recorded NPI of RM7.8 million, from RM43.1 million in 6M FY2020.

Meanwhile, the Office segment recorded higher gross revenue and NPI of RM25.0 million and RM15.2 million for 6M FP2021 respectively, lifted by the new income contribution from Sunway Pinnacle in 2Q FP2021. The Services segment also recorded gross revenue and NPI growth of 2.8% y-o-y to RM29.9 million. Gross revenue and NPI of the Industrial and Others segment is stable at RM3.1 million in 6M FP2021 compared to the same period last year.

Dato’ Jeffrey Ng, Chief Executive Officer of Sunway REIT Management commented, “After the spike in COVID-19 cases and reinstatement of MCO on 13 January 2021, we continue to maintain a cautious outlook in the near term. With the imminent rollout of the vaccine, the containment endeavour is likely to be more effective barring any unforeseen circumstances.”

He added, “We are currently working even more proactively with our tenants in these trying and uncertain times to address how best to help them tide through. That being said, we will remain vigilant to balance the wellbeing of our tenants, and at the same time, ensuring our financial capacity and flexibility is in optimum position via our prudent cost containment and capital management measures.”

Commenting further on the prudent capital management strategy, “Our current gearing of 37.4%, which is well below the new limit set by Securities Commission of 60% up to December 2022, plays a significant role in allowing us to be flexible in our portfolio and asset expansion strategy.”

“Despite the pandemic setback, we believe the prevailing challenging property market landscape shall provide an excellent opportunity for us to capitalize on, in order for us to unlock a new growth phase and build up our portfolio in line with our aspiration outlined in the TRANSCEND 2025 strategic objectives. The acquisition of Sunway Pinnacle via the private placement that was successfully completed in the midst of pandemic was a testament to our unwavering pursuit to acquire more assets, riding on the back of our strong financial capabilities, ultimately to offer better returns to our shareholders.”

As a concluding remark, Dato’ Jeffrey said, “We are definitely looking forward to the COVID-19 vaccine rollout this year to bring back some form of normalcy into the retail and hotel industries, as well as our daily lives. We are definitely hopeful that the retail and hotel industries will make a comeback once the pandemic is behind us.”