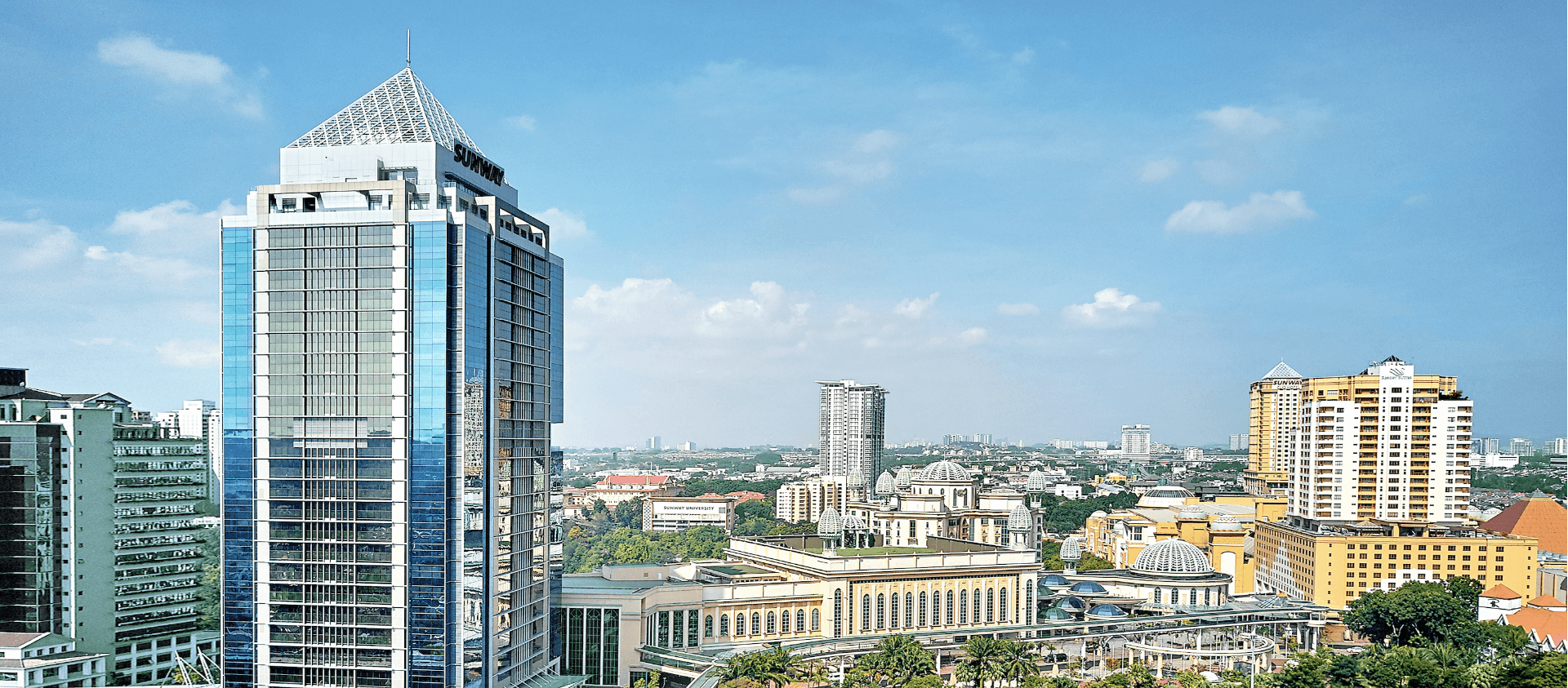

Sunway City Kuala Lumpur,08 November 2021

Sunway REIT Management Sdn. Bhd., the Manager of Sunway Real Estate Investment Trust (Sunway REIT), has released its financial results for the fifth quarter ended 30 September 2021.

Fifth quarter unaudited financial results for the period from 1 July 2021 to 30 September 2021 (5Q FP2021)*

*For comparison purposes, the same calendar period (July – September) is used to compare the year-on-year performance between 5Q FP2021 (1 July 2021 – 30 September 2021) and 1Q FP2021 (1 July 2020 – 30 September 2020).

Sunway REIT reported gross revenue of RM106.9 million in 5Q FP2021 compared to RM107.4 million in 1Q FP2021. Gross revenue was marginally lower due to lower contribution from the Retail segment which was impacted by the implementation of Enhanced Movement Control Order (EMCO) and National Recovery Plan (NRP) Phase 1. The impact was partially mitigated by higher gross revenue from the Office and Services segments. NPI increased 3.6% year-on-year (y-o-y) from RM68.1 million in 1Q FP2021 to RM70.5 million in 5Q FP2021 on the back of lower property operating expenses.

Gross revenue for the Retail segment eased 16.5% y-o-y to RM64.9 million in 5Q FP2021, from RM77.7 million in the same period last year, largely attributed to lower rental and carpark income owing to movement restrictions imposed during EMCO and NRP. Correspondingly, NPI decreased 17.1% y-o-y in the quarter under review to RM36.6 million, from RM44.2 million in the same period last year.

Gross revenue for the Hotel segment improved to RM6.2 million in 5Q FP2021, from RM2.8 million in the corresponding period last year, mainly attributed to guaranteed rent from Sunway Putra Hotel and quarantine business at Sunway Lagoon Hotel. NPI for the Hotel segment more than tripled to RM4.2 million in 5Q FP2021, from RM1.2 million in the same period last year.

Meanwhile, gross revenue for the Office segment surged 80.8% y-o-y to RM18.9 million in 5Q FP2021, from RM10.5 million in the corresponding period in the preceding year. NPI more than doubled to RM12.8 million in 5Q FP2021, from RM6.3 million in the same period last year. The improved performance was boosted by new income contribution from Sunway Pinnacle and largely stable average occupancy rate across all office properties in Sunway REIT’s asset portfolio.

Gross revenue and NPI for the Services segment edged up 2.8% y-o-y to RM15.3 million, attributed to annual rental reversion of Sunway Medical Centre (Tower A & B) and Sunway university & college campus. Meanwhile, gross revenue and NPI for the Industrial & Others segment remained stable at RM1.5 million in 5Q FP2021.

Cumulative fifteen months unaudited financial results for the period from 1 July 2020 to 30 September 2021 (15M FP2021)*

Due to change of financial year end from 30 June to 31 December, there are no comparative financial information available for the preceding year corresponding period.

Sunway REIT reported gross revenue of RM517.8 million and NPI of RM334.0 million for 15M FP2021. The overall performance for Sunway REIT during the period was impacted by the various phases of movement control orders.

The Retail segment recorded encouraging recovery in 1Q FP2021 following the easing of movement restrictions before the momentum retracted subsequently with the resurgence of COVID-19 cases in September 2020 which has led to the re-introduction of targeted restrictive movement measures. For 15M FP2021, the Retail segment recorded gross revenue of RM311.6 million and NPI of RM164.1 million. The average occupancy rate for the Retail segment remained stable at above 90%.

The Hotel segment recorded gross revenue of RM40.0 million and NPI of RM31.9 million in the period under review, largely supported by guaranteed income from Sunway Clio Property (comprising Sunway Lagoon Hotel and Sunway Clio Retail), Sunway Putra Hotel and Sunway Hotel Georgetown, amidst various phases of movement control orders in Malaysia. In addition, Sunway Resort Hotel remained closed during the period due to ongoing refurbishment.

The Office segment registered a healthy gross revenue and NPI of RM82.5 million and RM54.4 million respectively for 15M FP2021. The Office segment has benefitted from new income contribution from Sunway Pinnacle which was further supported by healthy average occupancy rate for the office portfolio.

Meanwhile, gross revenue and NPI for the Services segment stood at RM75.9 million for 15M FP2021 contributed by annual rental reversion for Sunway Medical Centre (Tower A & B) and Sunway university & college campus. The Industrial & Others segment posted gross revenue and NPI of RM7.7 million for 15M FP2021.

Dato’ Jeffrey Ng, Chief Executive Officer of the Manager, commented, “Undoubtedly, the pandemic had adversely impacted many businesses, not to mention that it had severely impacted our tenants’ operations. Looking back, we are heartened that the asset managers proactively worked hand-in-hand to establish the rental and marketing assistance programme as well as a third-party financing programme for affected tenants. The bonds and trusts forged in this tumultuous period had allowed us to maintain a strong occupancy rate in our assets portfolio. We are confident that Sunway REIT is in a position of strength to ride on the economic recovery.”

Dato’ Jeffrey added, “Sunway REIT is actively exploring acquisition opportunities presented following the fallout of the pandemic. Sunway REIT is in a favourable position to capitalise on yield accretive acquisition opportunities given its healthy balance sheet and debt headroom.”

Sharing on the prospects, he elaborated, “Malaysia is achieving its vaccination target and we are seeing better days ahead of us with the full reopening of the economy and close to 100% of Malaysia’s adult population inoculated. As Malaysia gradually transition from pandemic to endemic, we expect full reopening of the economy and further easing of inter-state border restrictions followed by the re-opening of the international borders which is paramount for a true restart of the tourism industry. Sunway REIT observed encouraging return of footfall within its assets portfolio, indicating green shoots of sustainable business recovery moving forward.”

Dato’ Jeffrey commented on the Retail and Hotel segments, “We are pleased to share that all of our tenants and employees are fully vaccinated, with the exception of those with health conditions. We continue to adhere to enhanced safety measures in our endeavour to provide a safer place for visitors to patronise the premises. The Business Units Management Teams have also launched attractive theme park-accommodation-retail promotional packages to entice visitations to Sunway City Kuala Lumpur to capture the domestic leisure market share.”

Dato’ Jeffrey concluded, “Taking cues from the recent surge in domestic flights and hotel reservations in key tourist destinations, strong demand for domestic tourism activities is expected to persist until the international border restriction is fully lifted.”