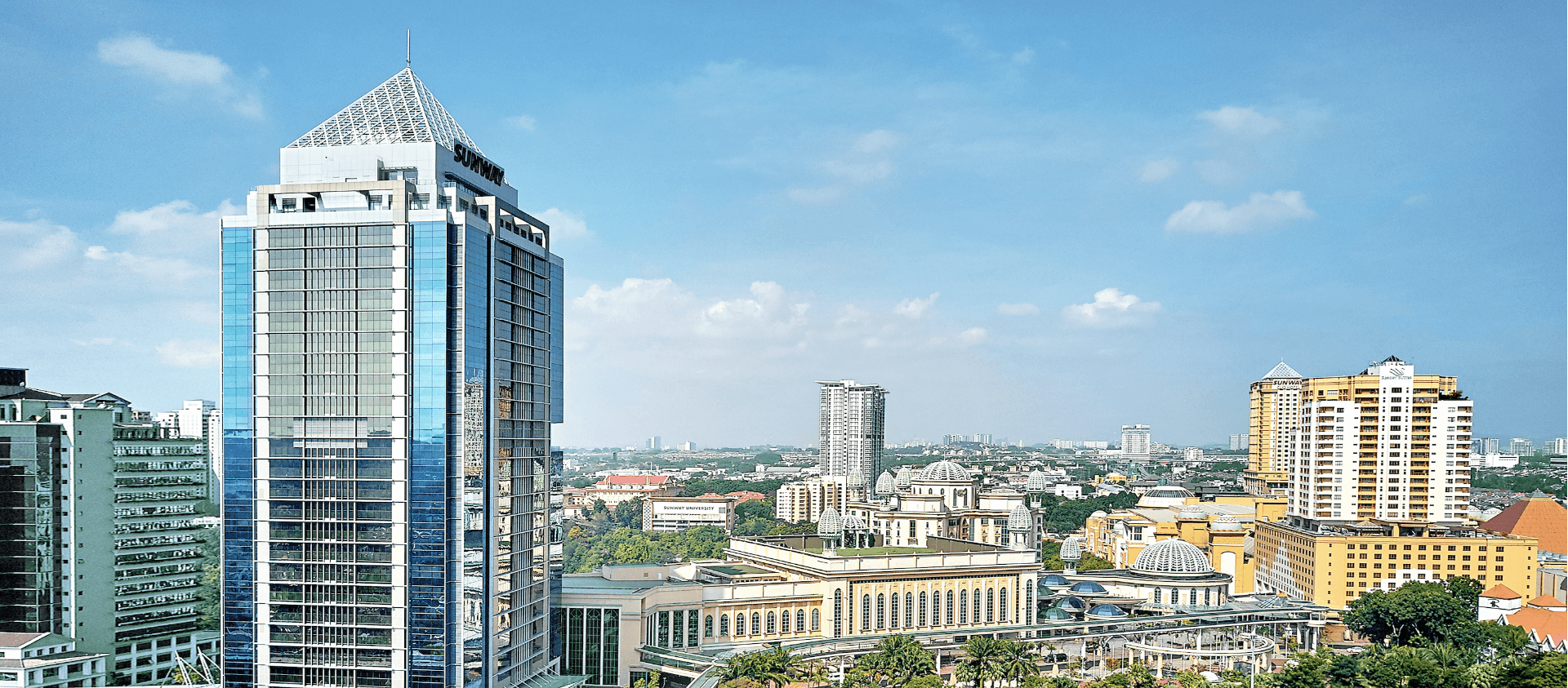

Sunway City Kuala Lumpur,18 May 2021

Sunway REIT Management Sdn. Bhd., the Manager of Sunway Real Estate Investment Trust (Sunway REIT), is pleased to announce its financial results for the third quarter ended 31 March 2021.

Third quarter unaudited financial results for the period from 1 January 2021 to 31 March 2021 (3Q FP2021)

Sunway REIT recorded gross revenue of RM104.3 million and net property income (NPI) of RM 67.0 million for the third quarter ended 31 March 2021 versus RM140.8 million and RM103.5 million respectively for the corresponding quarter in the preceding year (3Q FY2020). The set of financial performance was largely due to lower contribution from the Retail and Hotel segments on the back of imposition of MCO 2.0. However, it was partially cushioned by higher contribution from the Office and Services segments.

The Retail segment recorded gross revenue and NPI of RM53.7 million and RM23.9 million respectively in 3Q FP2021. In the corresponding quarter in the preceding year, the retail segment registered gross revenue and NPI of RM98.3 million and RM67.1 million respectively. The financial performance for the Retail segment was hindered by the scaled-back business operations caused by restrictions and SOP imposed during MCO 2.0. In addition, Sunway REIT continued to commit to rental support programme to assist affected retail tenants on a case-to-case basis to ensure business sustainability of these tenants.

The Hotel segment recorded gross revenue of RM14.4 million for the quarter under review versus RM15.3 million in 3Q FY2020. Correspondingly, the Hotel segment reported NPI of RM12.8 million in 3Q FP2021 compared to RM13.5 million in 3Q FY2020. The financial performance for the quarter was predominantly boosted by guaranteed income received for Sunway Clio Property and Sunway Hotel Georgetown. Sunway Resort Hotel is currently undergoing a transformative refurbishment to position Sunway REIT’s flagship hotel into a prestigious tourist and business destination in Sunway City Kuala Lumpur. The financial performance was further exacerbated by restrictions on inter-state, inter-district and inbound travel imposed during MCO 2.0.

The Office segment recorded a surge in gross revenue and NPI in 3Q FP2021, benefitted from the full-quarter contribution from Sunway Pinnacle pursuant to the completion of its acquisition in November 2020. The Office segment gross revenue soared from RM10.7 million in 3Q FY2020 to RM19.3 million in 3Q FP2021. NPI jumped more than two folds to RM13.4 million in 3Q FP2021 from RM6.4 million in 3Q FY2020, backed by stable occupancy rates as well as new income contribution from Sunway Pinnacle.

For the quarter under review, the Services segment edged up to RM15.3 million boosted by annual rental reversion of Sunway Medical Centre and Sunway university & college campus. The Industrial & Others segment income contribution remained stable at RM1.5 million.

Cumulative nine months unaudited financial results for the period from 1 July 2020 to 31 March 2021 (9M FP2021)

Sunway REIT registered gross revenue of RM307.5 million and NPI of RM201.1 million for the 9-month financial period ending 31 December 2021. For the corresponding period in the preceding year, Sunway REIT recorded gross revenue and NPI of RM452.0 million and RM339.2 million respectively. The financial performance of Sunway REIT was hampered by various stages of movement restrictions which adversely affected the business operations of the Retail and Hotel segments. However, this was partially mitigated by higher contribution from the Office and Services segments.

For the 9M FP2021, the Retail segment posted gross revenue of RM188.2 million, from RM310.6 million in the corresponding quarter in the preceding year. Despite encouraging recovery witnessed in the first quarter ended 30 September 2020, the subsequent implementation of Conditional Movement Control Order (CMCO) on 14 October 2020 and MCO 2.0 on 13 January 2021 have hindered the recovery trajectory of the Retail segment. NPI contracted to RM102.0 million for 9M FP2021, from RM216.4 million a year ago on the back of the ongoing rental support programme granted to affected tenants on a case-to-case basis.

The Hotel segment posted gross revenue of RM25.1 million for 9M FP2021, from RM61.5 million for the same period in the previous year, as the tourism and hospitality industry continued to be severely affected by the cross-border movement restrictions. NPI fell in tandem to RM20.6 million in the period under review from RM56.6 million in the same period last year.

Gross revenue for the Office segment jumped to RM44.3 million for 9M FP2021, from RM31.3 million in the same period last year. The higher contribution was mainly attributable to the new income contribution from Sunway Pinnacle pursuant to the completion of its acquisition in November 2020. In line with the jump in gross revenue, NPI surged from RM17.6 million for 9M FY2020 to RM28.6 million for 9M FP2021.

The Services segment’s gross revenue and NPI edged up to RM45.2 million for 9M FP2021 as a result of annual rental reversion for Sunway Medical Centre and Sunway university & college campus. The Industrial & Others segment posted a gross revenue and NPI of RM4.6 million for 9M FP2021.

On 10 February 2021, RAM Rating Services Berhad (RAM) reaffirmed the P1(s) rating for SUNREIT Capital Berhad, which is the highest rating on the short-term rating scale, for the RM3.0 billion Commercial Papers Programme, backed by solid credit profile.

Dato’ Jeffrey Ng, Chief Executive Officer of the Manager, commented, “Sunway REIT maintains a cautious outlook for the remaining of the year due to implementation of MCO 3.0 nationwide and uncertainties surrounding the business operating landscape in the coming months. The acceleration of mass vaccination rollout is crucial to containing the infection rate in order for the economy to recover.”

He added, “We laud the supportive policy measures by the government, such as PRIHATIN, PERMAI and PEMERKASA assistance packages which are aimed to ease the burden of businesses and rakyat. The continuation of these relief measures is crucial amidst heightened uncertainties surrounding the rising COVID-19 cases and ongoing containment measures. Whilst these containment measures are necessary to curb the spread of the infection, we expect business disruptions in the short term. A case in point was the unexpected mandatory closure order for retail malls, hypermarkets and offices listed under the Hotspot Identification for Dynamic Engagement (HIDE), which have disrupted business operations, especially for the retailers who had to incur additional operational losses due to the closure. We urge the authorities to engage and collaborate with industry players to jointly implement safety and hygiene measures in the premises. It would be helpful if the authorities are able to release the HIDE supporting data and information in order for the owners of the malls and premises to make relevant decision to work with the affected outlets and areas by following stricter SOPs, instead of immediate closure implementation which would cause further adverse pressure on the tenants, businesses, and mall owners.”

Dato’ Jeffrey added, “We continue to support affected tenants on a case-to-case basis in these trying times to brace through the storm together through the rental assistance and marketing support programmes. I am pleased that Sunway REIT’s retail portfolio is able to maintain a healthy average occupancy rate of 95% for the 9-month period of FP2021. Managing attrition aside, we have taken this opportunity to continuously enhance the tenancy mix with refreshing retail offerings which appeal to consumers.”

Commenting further on Sunway REIT’s strategic direction, he said, “The economic fallout from the pandemic has led to more properties being offered in the real estate market. In our opinion, this is an opportune time to actively pursue asset acquisition. Sunway REIT is in a favourable position, supported by healthy gearing level and comfortable debt headroom to capitalise on yield-accretive acquisition and asset expansion opportunities to drive future growth of Sunway REIT.”

Dato’ Jeffrey concluded, “In supporting the National Immunisation Programme, Sunway Pyramid Convention Centre was designated as the COVID-19 vaccination centre for Petaling district, targeting to vaccinate up to 1.8 million people. In support towards this ESG initiative, our estimated contribution of RM28 million derived from the complimentary use of the 150,000 sq.ft. convention centre space for a duration of 11 months including cleaning and sanitation costs throughout the duration. We urge fellow Malaysian to participate in the mass vaccination programme in order to strive towards a safe nation.”